About

The Office of Financial Aid is dedicated to educating students regarding the various aid programs that make attending college affordable for all. We offer flexible hours of service, and our financial aid counselors are available to assist students with the financial aid process. Students can finance their college education through need-based federal and state grants, scholarships, federal work study and low- interest Federal Direct Stafford Loans.

Current Kean students can view their financial aid application status, missing documents and awards through the Financial Aid Self Service. Simply use your KeanWISE log- in credentials to access your account.

Our page is full of helpful information so please check it out. If you don't find what you're looking for here, please call us at (908) 737-3190 or email us at finaid@kean.edu with any questions you may have. You can also "LIKE" us on https://www.facebook.com/KeanFinancialAid

| Office Hours: August 20-25, 2018 | |

|---|---|

| Monday, August 20 | 8:00 a.m. - 5:00 p.m. |

| Tuesday, August 21 | 8:00 a.m. - 5:00 p.m. |

| Wednesday, August 22 | 8:00 a.m. - 6:00 p.m. |

| Thursday, August 23 | 8:00 a.m. - 6:00 p.m. |

| Friday, August 24 | 8:00 a.m. - 5:00 p.m. |

| Saturday, August 25 | 9:00 a.m. - 1:00 p.m. |

| Sunday, August 26 | Closed |

| Office Hours: August 27 - September 1, 2018 | |

|---|---|

| Monday, August 27 | 8:00 a.m. - 6:00 p.m. |

| Tuesday, August 28 | 8:00 a.m. - 6:00 p.m. |

| Wednesday, August 29 | 8:00 a.m. - 6:00 p.m. |

| Thursday, August 30 | 8:00 a.m. - 6:00 p.m. |

| Friday, August 31 | 8:00 a.m. - 5:00 p.m. |

| Saturday, September 1 | Closed |

| Sunday, September 2 | Closed |

| Phone Hours | |

|---|---|

| Monday - Friday | 8:00 a.m. - 5:00 p.m. |

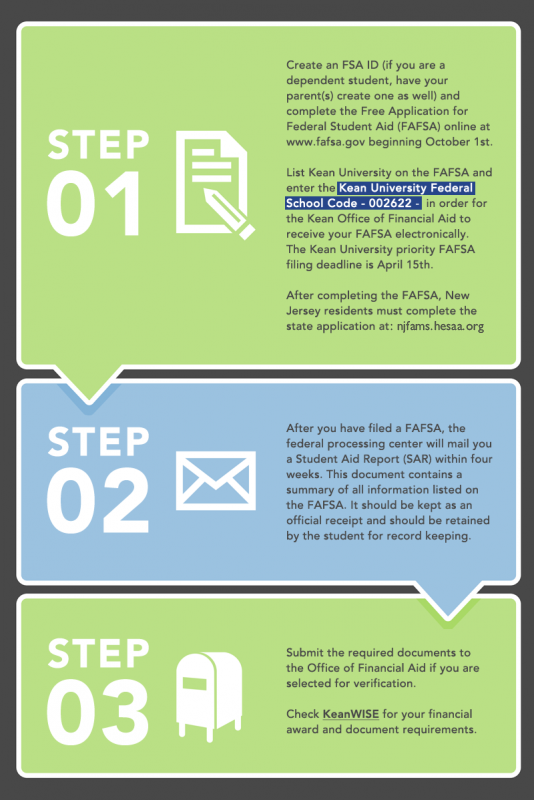

2018-2019 FAFSA - Available Now

The 2018-2019 Free Application for Federal Student Aid (FAFSA) is available for students to complete at fafsa.gov. File the FAFSA early, to be considered for Federal and State assistance for the Fall 2018, Spring 2019, and/or Summer 2019 terms.

To complete the FAFSA, you will need to provide your and/or your parents' 2016 income and current asset information. If you or your parents filed a 2016 Federal Tax Return, you may be able to transfer IRS data onto your application by using the IRS Data Retrieval Tool on FAFSA on the Web.

You must sign FAFSA on the Web with your FSA ID; likewise for one of your parents if you are a dependent student. To create a FSA ID (or to retrieve if you forgot your username or password), go to fsaid.ed.gov.

Have you completed your FAFSA yet? If not, you may find this video tutorial may be very helpful.

How To Apply for Financial Aid

How To Apply for Financial Aid

The Free Application for Federal Student Aid (FAFSA) is the only application used to apply for need-based financial aid for Federal programs.

New Jersey Undergraduates - Report additional information to the State of NJ, to be considered for Tuition Aid Grant (TAG) and other State programs. If you did not complete this step after submitting FAFSA on the Web, log in to NJ FAMS.

Tuition and Fees

2018-2019 Estimated Summary of Costs (Per Semester)

| In-State | Out-of-State | |

| Tuition and Fees | $6,173.75 | $9,691.25 |

| Room and Board | $7,235.00 | $7,235.00 |

| Total | $13,408.75 | $16,926.25 |

*Based on full-time status. Room for residence is based on double occupancy. Board is based on Freshman meal plan.

Please visit our Tuition and Fees page for full listing.

Types of Aid

Grants awarded to students who show they have financial need. Grants typically do not require repayment

Loans a source of aid that must be repaid, usually with interest, after you graduate or stop going to school

Scholarships awarded to students based on special talents, skills or high academic achievement

Federal Work Study a program where students may work and earn money to help pay for school

Financial Aid Calendar

| September 15, 2017 | NJ STATE | Deadline for new students (and continuing & transfer students who did not receive 2016-2017 TAG) to file the 2017-2018 FAFSA, for Fall 2017 and Spring 2018 State Aid |

| September 20, 2017 | UTW | Last day to submit a completed Unemployment Tuition Waiver Form for Fall 2017 |

| October 1, 2017 | FEDERAL, NJ STATE | The 2018-2019 Free Application for Federal Student Aid (FAFSA) available to all students, to apply for aid for the upcoming year |

| October 1, 2017 | NJ STATE | Deadline for updating a college choice for Fall 2017 and Spring 2018 |

| November 1, 2017 | NJ STATE | Deadline for TAG recipients to complete 2017-2018 State Grant records (report Additional Information, submit State Verification documents) with the NJ Higher Education Student Assistance Authority (HESAA) |

| November 30, 2017 | FEDERAL | Recommended last day to file the 2017-2018 FAFSA for the Fall 2017 semester, for students not returning in Spring 2018. Applications filed after this date may be subject to delays which could affect eligibility. |

| January 10, 2018 | UTW | Last day to submit a completed Unemployment Tuition Waiver Form for Winter 2018 |

| January 16, 2018 | Satisfactory Academic Progress Appeals | Last day to submit a Satisfactory Academic Progress appeal form to be considered for Spring 2018 aid. Appeals will not be accepted beyond this date. |

| January 31, 2018 | UTW | Last day to submit a completed Unemployment Tuition Waiver for Spring 2018 |

| February 15, 2018 | NJ STATE | Deadline for non-renewal TAG recipients to file the 2017-2018 FAFSA for Spring 2018 State Aid |

| March 1, 2018 | NJ STATE | Deadline for non-renewal TAG recipients to update a college choice for Spring 2018 |

| April 15, 2018 | INSTITUTIONAL | Priority filing deadline date for filing the 2018-2019 FAFSA. Applications filed after this date may be subject to delays which could affect eligibility |

| April 15, 2018 | NJ STATE | Deadline for 2017-2018 TAG recipients to file the 2018-2019 FAFSA, for Fall 2018 and Spring 2019 State Aid |

| April 27, 2018 | FEDERAL | Recommended last day to file the 2017-2018 FAFSA for students attending the Spring 2018 semester only. Applications filed after this date may be subject to delays which could affect eligibility. |

| May 30, 2018 | UTW | Last day to submit a completed Unemployment Tuition Waiver for Summer 2018 Session I |

| May 31, 2018 | Satisfactory Academic Progress Appeals | Last day to submit a Satisfactory Academic Progress Appeal Form, to be considered for aid during Summer 2018 Sessions I and II |

| June 18, 2018 | FWS | The Office of Financial Aid begins accepting applications for Federal Work-Study for the 2018-2019 School Year. |

| June 30, 2018 | FEDERAL | Last day to file an initial 2017-2018 FAFSA. (Contact the Office of Financial Aid, as some restrictions may apply.) |

| July 10, 2018 | UTW | Last day to submit a completed Unemployment Tuition Waiver for Summer 2018 Session II |

| August 1, 2018 | Satisfactory Academic Progress Appeals | Last day to submit a Satisfactory Academic Progress Appeal Form, to be considered for Fall 2018 aid. Appeals will not be accepted beyond this date. |

| September 15, 2018 | NJ STATE | Deadline for non-renewal TAG recipients to file the 2018-2019 FAFSA, for Fall 2018 and Spring 2019 State Aid |

| September 18, 2018 | UTW | Last day to submit a completed Unemployment Tuition Waiver Form for Fall 2018 |

Important Telephone Numbers

1-800-792-8670 to inquire about your NJ State aid eligibility

1-800-433-3243 to inquire about your Student Aid Report (SAR) for Federal Aid

Students who apply after the deadline are responsible for paying their college cost while their financial aid application is being processed.

**The Office of Financial Aid reserves the right to modify the above dates without prior notice.

Frequently Asked Questions

What Is The Correct Website For The Free Application for Federal Student Aid (FAFSA)?

fafsa.gov

What Is a FSA ID? Where Do I Register For One?

The FSA ID is comprised of a username and password and is used to login to certain Federal Student Aid websites, such as fafsa.gov and studentloans.gov. It is also used as an electronic signature.

All students (and parents of dependent students) must create a FSA ID at https://fsaid.ed.gov.

What is Kean University's FAFSA Federal School Code?

002622

How Long Will It Take Before Kean University's Office Of Financial Aid Receives A Report Of My Submitted FAFSA?

If you have completed the FAFSA (with Kean University listed as a recipient), we will generally receive notification within 2-3 weeks. Only students offered admission to Kean will receive an award notification (see next question) and/or request for additional inofrmation.

After I Submit My FAFSA, What Types Of Feedback Will I Receive?

Generally, you will receive:

-

Student Aid Report (SAR) from the Federal Government. The SAR will provide a summary of your FAFSA and list any problems with the application. The SAR will inform the student if additional information must be provided to the school. It will also notify you of your estimated eligibility for the Federal Pell Grant and Direct Stafford Loans.

-

Notification from the State of New Jersey regarding your estimated eligibility for the NJ Tuition Aid Grant (TAG) and/or if any additional information must be provided to the State.

-

Kean University Financial Aid Award notification via your Kean email and KeanWise accounts.

-

The Office of Financial Aid may require you to submit specific documents in order to complete your aid package. You will also be notified of any document requests through your Kean email and KeanWise accounts.

Why Can't My Parent Call and Get Answers About My Financial Aid?

FERPA (Family Educational Rights and Privacy Act) regulations limit the information that can be released to someone other than the student. Students can use their KeanWise account to grant a parent or other third party access to their educational records by following the instructions under the section marked “Student Educational Records Release” on KeanWise.

I Need More Money To Pay For School. Where Can I Obtain Scholarship Information?

The Office of Scholarship Services can assist students with information pertaining to Kean University scholarships. For additional loans, parents of dependent students can apply for a Parent PLUS Loan and all students can apply for Private Loans.

Should I Fill Out A FAFSA If I Am Not Sure That I Will Need Financial Aid?

Circumstances can change, and it is helpful to submit a FAFSA. You may find that you are eligible for grants or loans with little to no interest. By filing the FAFSA, your information will be processed and available for you in case you decide you may want or need aid.

I Pay My Own Bills And I Think I Am Independent. Do I Need To Provide My Parents' Information On My FAFSA?

Step 3 of your FAFSA will determine if you can be considered an independent student. Most undergraduate students are considered dependents of their parents for financial aid purposes, and the parent information should be supplied. If there are unusual circumstances, you may apply for a Dependency Override.

The Appeal for Dependency Override is available under Forms. This form is award-year specific (e.g., 2018-2019), so select the appeal for the year you wish to be evaluated.

I Have Unusual Circumstances That May Affect My Ability To Pay For School (Unemployment, Disability, etc). What Can I Do?

You may complete a Special Condition Application, which requires copies of certain documents to substantiate your circumstance and to assist the counselor in determining your eligibility for additional aid. Once this application and supporting documents are submitted, the Office of Financial Aid will reveiw your information and determine whether any adjustments can be made to your financial aid eligibility.

The Special Condition Application is available under Forms. This application is award-year specific (e.g., 2018-2019), so select the form for the year you wish to be evaluated.

Why Are You Asking Me For Copies Of My IRS Tax Return Transcripts and W2'S?

If a student is selected for a process called verification, the school is required by the Federal government to collect certain documents from the student and (for dependent students) their parents. Students who fail to submit the requested information may be ineligible to receive financial aid for that academic year.

What Is An IRS Tax Return Transcript And How Can I Get It?

The U.S.Department of Education has instructed schools to obtain IRS Tax Return Transcripts for students who are selected for verification. Therefore, the Office of Financial Aid can no longer accept tax return forms 1040, 1040A or 1040EZ. Students can visit the IRS website and request an IRS tax return transcript via a downloadable PDF file or through the mail. The IRS will mail the transcript to your home (usually within 5-10 days). There is no charge for an IRS tax return transcript.

What Is The IRS Data Retrieval Tool?

When completing the FAFSA, students who qualify will be asked if they would like to use the IRS Data Retrieval tool. The FAFSA will redirect you to the IRS website, where you can transfer your tax information directly on to the FAFSA to ensure you do not make any mistakes. If you are eligible to use the tool, it is highly recommended that you use this method to report your income data. Once you upload the information, do not change any of the income figures.

I Submitted The Required Document; When Should I Expect My Financial Aid To Be Posted?

The verification process typically takes about 2-3 weeks (processing may take longer during peak time). Once it is completed, your aid package will be finalized (unless changes to your enrollment status or Satisfactory Academic Progress status occur). If any corrections were made to your FAFSA during verification, you will receive a revised award letter and an updated SAR.

How Do I Apply For A NJ Tuition Aid Grant (TAG)?

After completing your FAFSA, the confirmation page will prompt you to complete your State application. If you did not do this, log in to https://njfams.hesaa.org and click the "To Do List" to apply for TAG and other State programs.

What Is SAP? What Are The Requirements?

All students receiving financial aid are required to meet minimum Satisfactory Academic Progress (SAP) standards. For a full explanation of this policy, please see click to see the Satisfactory Academic Policy section of our website.

What Is Federal Work Study (FWS)?

Federal Work Study is financial aid assistance available to students with “financial need” (as determined by the FAFSA) that is received as a bi-weekly paycheck based on hours worked at an assigned on or off campus department. FWS does not go directly toward the cost of tuition, fees, or housing. The number of job assignments is limited.

How Can I Apply For FWS?

The FWS application can be found here. A step-by-step outline of the application process can be found here. AFTER the application is submitted to the Office of Financial Aid, you will receive an email from the Federal Work Study Coordinator with additional instructions.

What Jobs Are Available For FWS Students?

Once the student meets with the FWS coordinator, he/she will be notified of available positions on and off campus. We try our best to place students in departments that fit their skills and interests.

I Need To Speak To A Financial Aid Counselor. How Do I Do That?

If you would like to speak to a specific financial aid counselor, you can schedule an appointment with them here. You can also walk-in any time during our office hours and someone will be available to assist you. Our normal office hours are 8am-6pm Mon, Tues, and Thurs; 8am-8pm on Wednesdays; 8am-5pm on Fridays; and 9am-1pm on most Saturdays. Please note that these hours may change during the summer sessions, winter break, spring break, etc. Students can also email us at finaid@kean.edu or call us at (908)737-3190 8am-5pm, Mon-Fri. Note that our phone hours differ slightly from our in-office hours.

Do I Need To Complete A FAFSA Every Year For Financial Aid?

Yes. Each academic year is separate, and the FAFSA is needed in order to receive aid.

What Is The Master Promissory Note (MPN)? What Is Entrance Counseling?

The MPN and Entrance Counseling are online forms that first-time Federal Direct Stafford Loan borrowers must complete before receiving any loan disbursement. You can complete both at https://studentloans.gov.

Federal Perkins Loans borrowers will receive the MPN and Entrance Counseling forms in their email. They are to be filled out entirely and sent back to the Kean University Office of Financial Aid.

I Don't Want The Loans Offered To Me. What Do I Do?

You can decline your loans on your KeanWise account under the section marked “Accept/Reject Loans.” You can also decline and/or reduce your loans in person by submitting a signed Loan Adjustment Form to the Office of Financial Aid.

How Can I Apply For The PLUS Loan?

A parent of an undergraduate dependent student can apply for a Parent PLUS Loan at studentloans.gov. Parents are required to complete a Master Promissory Note in order to complete the PLUS Loan application process. Graduate students can apply for a Graduate PLUS at the same website. We begin accepting PLUS Loan applications for upcoming years on July 1st.

Are Student Loans, Parent Loans, and Private Loans Considered Financial Aid?

Yes. Although loans are funds that must be repaid, they are considered a type of financial aid.

Are My KeanWise Password and FSA ID Number The Same?

No. The FSA ID is used only for Federal Student Aid websites, and your KeanWise password is administered by Kean University.

Forms

| 2017-2018 Forms: contact the Office of Financial Aid |